The silent dealmaker: How AI is transforming portfolios and driving valuations.

AI for value creation in private equity

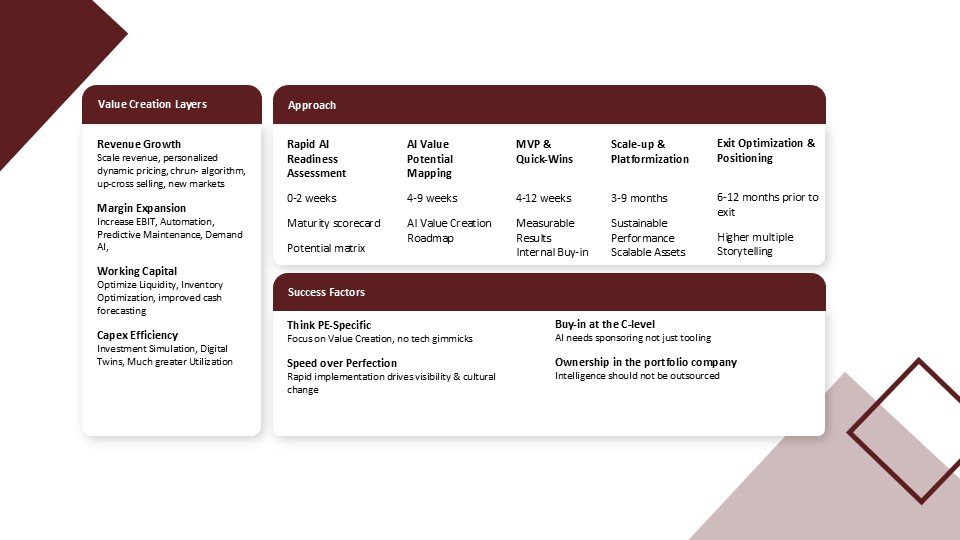

Creating value begins with the question: What can be scaled, automated, and managed intelligently?

Private equity (PE) is under increasing pressure to transform: shorter holding periods, higher purchase prices, more demanding investors. Traditional levers such as staff cuts, purchasing conditions, and standardization are no longer sufficient to achieve the desired EBIT multiplier. Anyone who is serious about value creation today cannot ignore AI—not as a tool, but as a strategic accelerator.

Why AI is a game changer in the PE context:

Unlike corporations, PE investors aim for rapid, substantial improvements in results. AI offers exactly that: it identifies inefficiencies, automates routines, reduces manual errors, and creates scalable intelligence in core processes. Above all, AI is the only lever that simultaneously impacts EBITDA, working capital, and valuation multiples.

Our approach to delivering MORE value

The Value Creation framework aims to establish artificial intelligence as a targeted multiplier in the private equity context – with a clear focus on EBITDA growth, working capital efficiency, and multiple expansion at exit. It creates a structured approach to achieve rapid impact, deliver measurable value, and translate technological maturity into an investor-relevant storyline.

0

0

0

SC X AS PARTNER

Speed and scalability

We bring proven frameworks, preconfigured toolkits, and scalable use cases to the table. This reduces implementation time, minimizes friction, and maximizes time-to-value.

PE-compatible thinking

Unlike traditional technology providers, SC X consultants with PE experience think in terms of valuation, cash flow, and transformability. They combine technical expertise with deal and exit logic.

Resource relief in the portfolio

Many medium-sized portfolio companies do not have the internal capacity or expertise to carry out AI initiatives on their own. SC X acts as a temporary delivery unit with a clear handover plan.

risk minimization

Through structured due diligence, tool validation, and stakeholder management, we reduce project risks—both technological and cultural.

Exit optimization

As an experienced consultant, SC X knows how to translate AI successes into a compelling equity story – including traceability, IP structure, tech DD preparation, and arguments for multiple expansion.

Scalable value creation

Working with specialized SC X AI consultants is not a cost center for PE firms—it is an investment in controlled, measurable, and scalable value creation.

Why customers choose us

PE thinking meets tech expertise:

We speak the language of investors – multiples, EBITDA, exit readiness. At the same time, we deliver technical substance: from use case definition to model scaling. The result: operational impact + strategic storytelling.

Implementation with speed and dept

Our teams deliver tangible results within a few weeks – measurable, traceable, scalable. No overengineering, no pilot processes that fizzle out – just transformation with timing.

Trust factor on the part of management and investors

We are not just external experts – we are temporary co-pilots. With a clear mandate, a neutral perspective, and the ability to build bridges between PE firms, management, and specialist departments.